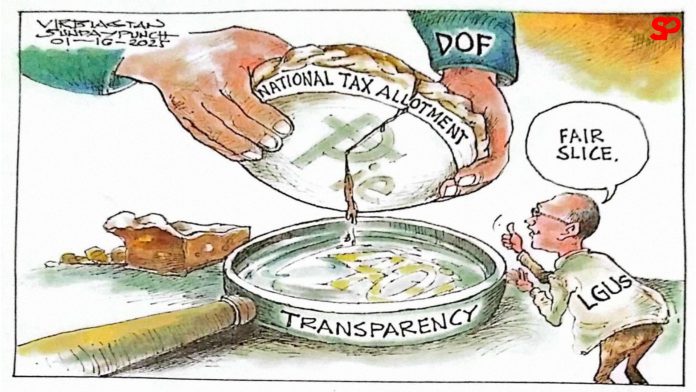

Illustration by: Virgilio Biagtan

The Department of Finance (DOF) has recently faced scrutiny from local government units (LGUs) regarding the computation and distribution of the National Tax Allotment (NTA). Baguio City Mayor Benjamin Magalong, representing the Mayors for Good Governance (M4GG), has called for a dialogue with the DOF to clarify perceived discrepancies in the LGUs’ share of national taxes.

In response, Finance Secretary Ralph Recto has reaffirmed the DOF’s commitment to transparency and strict adherence to the Supreme Court’s Mandanas-Garcia ruling, which took effect in 2022. This landmark decision increased the NTA shares of LGUs to 40% of all national taxes, aiming to enhance their fiscal autonomy. Recto emphasized that the government is not shortchanging LGUs and is open to continued dialogues to address any concerns.

The apprehensions raised by local officials highlight the complexities involved in fiscal decentralization. Ensuring that LGUs receive their rightful share of national taxes is crucial for empowering local administrations to deliver essential services effectively. Transparent communication and collaborative problem-solving between national and local authorities are vital to address these issues and maintain trust in the system.

The Mandanas-Garcia ruling has reshaped the fiscal landscape for local governments, requiring them to take on greater responsibilities for development and service delivery. However, the transition has been far from seamless, with many LGUs citing challenges in adapting to the expanded scope of their functions. Clear and consistent guidance from the national government is essential to help them navigate these changes.

As discussions between the DOF and LGUs proceed, it is imperative that both parties work towards a mutual understanding and resolution. Establishing clear guidelines and providing detailed explanations of the NTA computation process can alleviate concerns and foster a more cooperative relationship. Ultimately, the goal should be to ensure that local governments are adequately funded to serve their communities, reflecting the true spirit of the Mandanas-Garcia ruling.

The push for transparency and equitable tax distribution is a cornerstone of effective governance. Addressing these concerns proactively will not only empower LGUs but also strengthen public trust in the government’s commitment to fiscal accountability and decentralization.