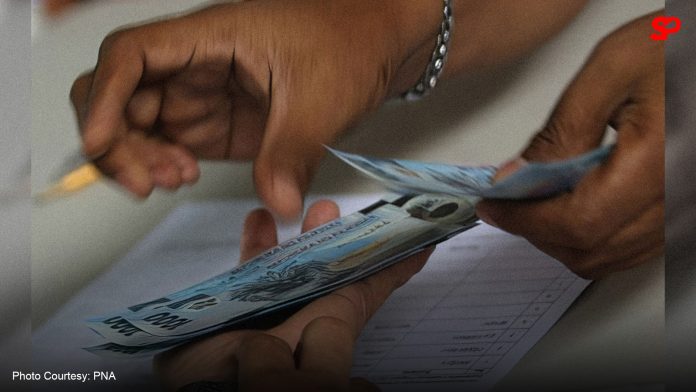

MANILA – Senator Robinhood Padilla on Tuesday filed a measure seeking to penalize abusive lending and financing companies that force borrowers to settle their debts through harassment, shaming and similar inhumane debt collection practices.

Padilla said he filed Senate Bill 2882 to give more teeth to Republic Act 9474 or the Lending Company Regulation Act and Republic Act 7394 or the Consumer Act.

“Over the years, the SEC [Securities and Exchange Commission], the National Data Privacy Commission and law enforcement agencies have received numerous complaints against FCs [financing companies] and LCs [lending companies] harassing, shaming, and employing abusive, unethical, and unfair means upon their customers/clients to force the settlement of debts,” he said in the bill.

He added that there is proliferation of misuse of the customer’s personal information and the public disclosure of unpaid loans or balances.

Under Senate Bill No. 2882, a fine of PHP 50, 000 shall be imposed for the first offense; PHP100,000 for the second offense; PHP 500, 000 to PHP1 million and a 90-day suspension of lending and financing activities for the third offense; and the revocation of certificate of authority to operate as as financing/lending company for the fourth.

The FCs and LCs must also disclose information about their third-party service providers, including registered phone numbers used in debt collection, to the SEC and the Bangko Sentral ng Pilipinas (BSP).

Unfair and abusive debt collection practices include the use of threat of violence or harm; use of obscenities, insults or profane language to abuse the borrower; use of social media and other online platforms to humiliate the borrower; disclosure or publication of borrowers’ personal information; and contacting the borrower at unreasonable or inconvenient hours.

“Notwithstanding the borrower’s consent, contacting the persons relatives, colleagues, or acquaintances other than those named as guarantors, surety, or co-makers shall also constitute unfair debt collection practice,” Padilla said.

The senator also raised that some lending companies even use third-party providers to evade liability from such unethical practices.

Padilla noted that the proposed measure also imposes on FCs and LCs the ultimate responsibility for the prohibited acts, to address the intentional evasion of liability. (PNA)